Financial Literacy Learning Pathway

Build practical money management skills through our structured program. From budgeting basics to investment concepts, develop financial confidence at your own pace.

Module Breakdown

Personal Finance Fundamentals

Start with essential money management skills. You'll learn practical budgeting techniques, how to track expenses effectively, and ways to identify spending patterns. This foundation module covers emergency fund planning and introduces basic financial terminology that you'll use throughout the program.

Credit & Debt Management

Navigate the complex world of credit wisely. This module explores how credit scores work, strategies for managing existing debt, and making informed decisions about loans and credit cards. Learn practical approaches to debt reduction while building positive credit history.

Investment Education

Understand investment basics without overwhelming complexity. We cover different investment types, risk assessment methods, and how to evaluate investment opportunities. Focus remains on education and understanding rather than specific investment advice.

Learning Assessment Methods

Practical Exercises

Apply concepts through hands-on budgeting exercises and financial planning scenarios that reflect real-world situations.

Progress Tracking

Monitor your learning journey with regular checkpoints and self-assessment tools that highlight areas of improvement.

Knowledge Reviews

Reinforce learning through periodic reviews and discussions that help consolidate key financial concepts.

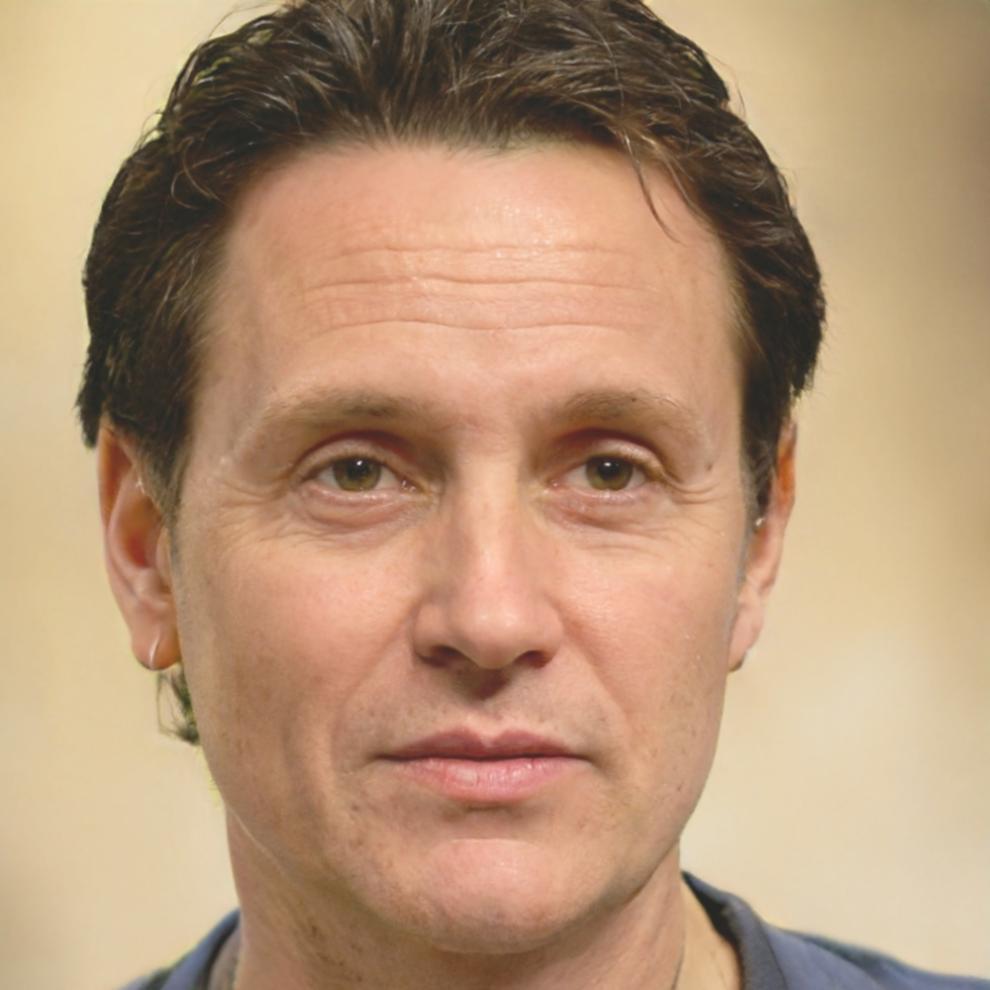

Fletcher Whitfield

Senior Financial Educator

With over fifteen years in financial education, Fletcher brings practical insights from working with individuals across various financial situations. His approach focuses on making complex financial concepts accessible while building genuine confidence in money management decisions.

Ready to Begin Your Financial Journey?

Our next program cohort starts in August 2025. Spaces are limited to ensure personalized attention and meaningful peer interaction.

Express Interest